To remain competitive, a company needs to have a clear vision of its expenses and control them rigorously. But to be effective, you also need the right tools! You need to choose tools that will give you a global view of your flows and that will enable you to make strategic decisions for your company.

Why is it essential to control your company’s expenses?

In an ever-changing business environment, companies need to have a clear view of their cash flows. This will enable them to make long-term decisions and to anticipate market fluctuations as effectively as possible.

How can an expense report solution help you?

When you think about controlling your expenses, you probably don’t immediately think about an expense report solution. But, did you know that it could become a real ally for your accounting team?

It gives you a global visibility of expenses and in-depth analyses, as well as a view of outstanding amounts, enabling you to better manage your company’s cash flow.

#1 – Instant collection of expenses

Your employees can instantly submit their expenses via an expense report application. They just need to take a photo of their receipt, and the software extracts all the information needed to complete the expense report:

- Date

- Amount

- Vendor

- VAT rate

- Etc.

Then, they simply click a button and the expense report is submitted! By collecting expenses instantaneously, you save time by ensuring that all information is provided from the outset.

No more risk of losing receipts, and no more incessant back-and-forth between the accounting department, managers, and employees to correct their expense reports!

What’s more, an application like N2F can automatically submit pending expense reports on a given date. For example, you can decide that all pending expense reports will be automatically sent for validation on the 20th of the month, giving you a clearer picture of current expenses, and allowing you to anticipate employee reimbursements with peace of mind.

#2 – Automatic validation of expenses

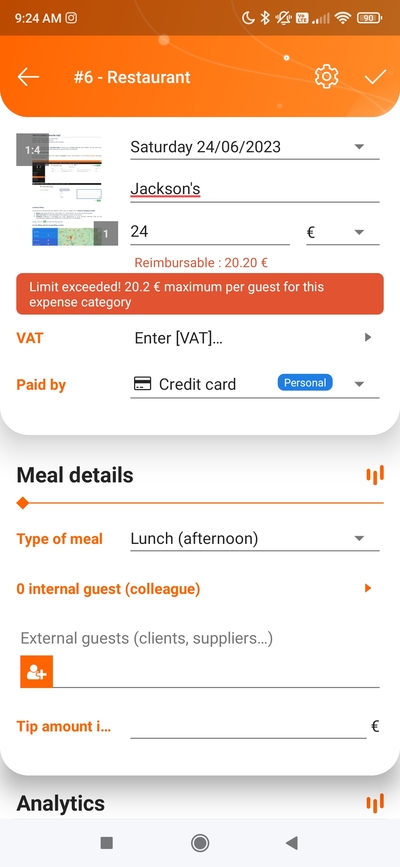

An expense report solution must be fully customizable to adapt to your company’s expense policy. No more surprises, you only reimburse costs that comply with your expense policy!

For example, if you have set a ceiling of €25 per meal and per guest, an expense report software program can detect an overspend and warn the employee that only €25 will be reimbursed.

As you can see, an expense report solution is an excellent way of immediately detecting non-compliant expenses and of managing your employees’ business travel expenses.

#3 – Budget analysis and cost control

To make strategic decisions for your business, you need global, real-time information.

Thanks to the statistical modules offered by expense report software, you can visualize trends in your company’s cash flow, which is ideal for your budget analysis and cost control!

This allows you to extract data linked to a project, a customer, or a cost center:

- Expenses by category (meals, travel, overnight stays, etc.)

- Amounts incurred per employee or department

- Expenses per project

- Vehicle fuel or electricity consumption

- Reimbursement period

- Etc.

For example, you can generate a monthly report of business travel expenses, and compare it with the allocated budget. In the event of an overspend, it will be easier for you to take corrective action or adjust the budget for the coming months.

💡 The statistical modules allow you to easily extract the expenses incurred on behalf of a customer, in order to re-invoice them for any travel expenses incurred.

#4 – Cost accounting

Financial accounting is based on a defined chart of accounts. Cost accounting adds another level of financial analysis to your accounting software: codes, cost centers, projects, customers, worksites, etc.

This helps you to assess the profitability of a site or project by adding up your expenses, including expense reports, and the related income.

An expense report application such as N2F will offer you analytical axes such as:

- Cost centers

- Projects

- Customers

- Payment methods

- Vehicles

- Businesses / assignments

- Etc.

#5 – Business intelligence

Business intelligence is the term used to describe decision-making based on your company data. Managing this information is essential to enable you to react rapidly to change, anticipate future developments, and optimize your expenditure.

And your accounting data is invaluable in helping you to identify areas for development and growth in the years ahead, as well as areas to watch out for. By making decisions based on facts, not assumptions, you can ensure the long-term future of your company!

Perhaps you didn’t realize, but an expense report solution provides precise, up-to-the-minute data on your company’s financial position. Uploading your employees’ expenses into your accounting axes will give you a global overview. The various analytical axes can also provide you with a granular view of the information.

An expense report solution linked to your accounting software will give you better visibility and control of expenses in real time. Instant expense collection, automatic validation, dashboards, and data analysis will all help you to manage your company’s expenses more effectively.

This will enable you to make strategic decisions based on accurate information, and reduce the risk of overspending (including fraud). Optimize your expense management now and improve your company’s profitability by switching to an expense report application!