Do you find yourself spending hours sorting through employee reimbursements? How about wanting to improve controls surrounding spending? Expense tracking is a fundamental component of every business, controlling where your money is being spent, maintaining compliance with regulatory agencies, and ensuring that proper fraud protocols are in place.

Unfortunately, maintaining an effective and efficient expense management function isn’t always easy, especially if you are still completing processes manually. From spending hours recording transactions to making undetected mistakes, many of the challenges of expense tracking can be overcome with the right software program.

In this article, we’ll outline the best expense tracking apps for small businesses. These companies were selected based on their features, benefits, and pricing, making them ideal solutions for small to medium-sized businesses. Here’s a short list of the companies we’ll cover:

- Expensify

- N2F

- QuickBooks Online

- Zoho Expense

- Wave

Key Criteria for Choosing an Expense Tracking App

Before we get into the features and pricing of specific small business expense management tools, let’s first define what you’re looking for when choosing a program. Here are some essential features to evaluate when searching for apps for managing business expenses:

- Ease of Use – The software program you choose should be easy to use, both for you and your team members.

- Receipt Scanning and Categorization – Many regulators require tangible proof of expenses in the event of an audit. As a result, your expense management tracking app should have the ability to upload and categorize receipts and invoices.

- Integration with Accounting Software – Expense tracking apps are a niche software program and don’t contain all of the capabilities of general accounting software. This means that you will most likely have a main program that houses all of your other financial information. Your expense tracking app should be able to integrate with your accounting software.

- Reporting and Analytics – Tracking spending habits relies on reviewing reports and analytics. The right expense tracking software program will have a plethora of reporting and analytics capabilities, adding transparency to your expenses.

- Cost-Effectiveness – Choosing budget-friendly expense trackers is important. After all, one of your main reasons for utilizing expense management software is cost control. However, don’t always choose the cheapest option. Instead, choose the program that offers you the most value in relation to price.

The five following expense tracking apps were selected based on these criteria.

The 5 Best Expense Tracking Apps for Small Businesses

Now that we’ve outlined important criteria to keep in mind, let’s go through the five best expense tracking apps for small businesses. Remember, this expense tracking software comparison contains the five companies we believe are the best. Every organization will have different goals and priorities, making it important to evaluate each program in relation to your company’s needs.

Expensify:

- Overview: App geared toward employee travel and expense reimbursements.

- Features: Receipt scanning, mileage and GPS tracking, automatic credit card importing, travel management.

- Best For: Small businesses wanting to reimburse employees.

- Pricing: Starts at $5/month per member.

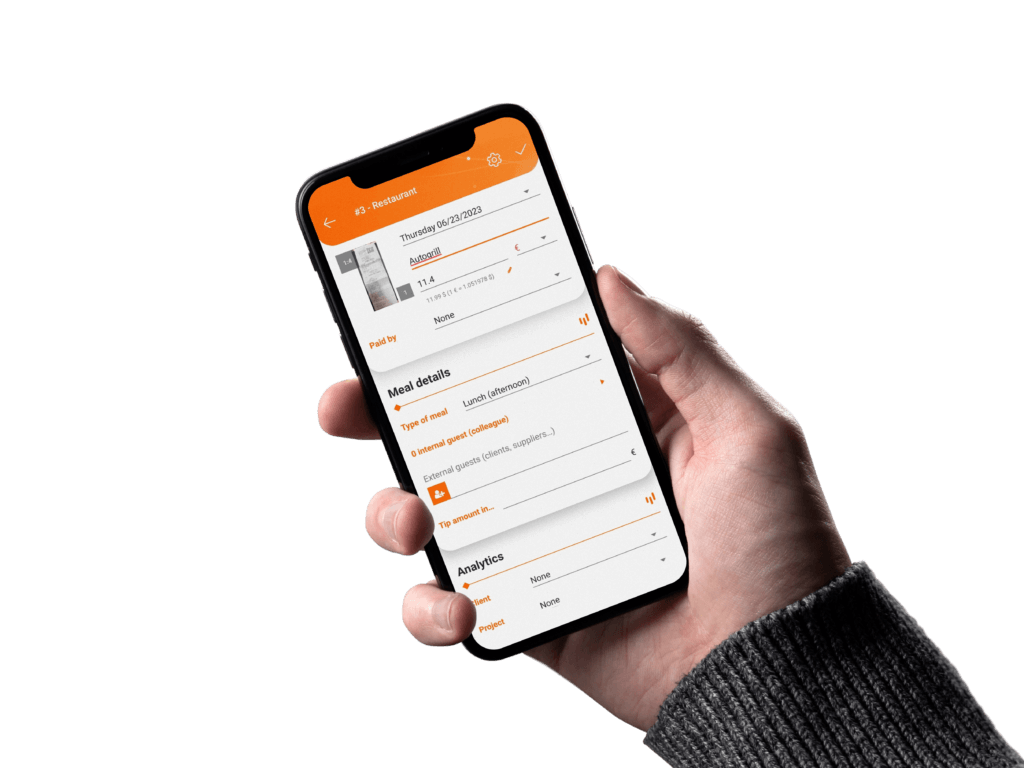

N2F:

- Overview: User-friendly app designed for small and mid-sized businesses.

- Features: OCR-powered receipt scanning, mileage tracking, customizable reports.

- Best For: Teams seeking an affordable, scalable solution.

- Pricing: Starts at $4,53/month, with a free 20 days trial.

QuickBooks Online:

- Overview: Scalable accounting software designed for growing teams.

- Features: Receipt scanning, mileage tracking, customizable reports, budget comparisons.

- Best For: Small to mid-sized businesses looking for an all-in-one program.

- Pricing: Starts at $35/month.

Zoho Expense:

- Overview: Cloud-based program for tracking employee reimbursements and per diems.

- Features: Mileage tracking, project billing, integrative dashboard.

- Best For: Businesses using Zoho Books and looking for more robust expense tracking features.

- Pricing: Free use of limited features. Other plans start at $4/month per user.

Wave:

- Overview: Mobile and online program for businesses looking to reimburse employees and initiate online payments.

- Features: Invoicing, mobile receipts, payroll processing, electronic payments.

- Best For: Small to medium-sized businesses looking for basic expense management.

- Pricing: Starts at $16/month.

Benefits of Using Expense Tracking Apps

Expense tracking apps do more than just streamline employee reimbursements. For one, they improve efficiency and accuracy in financial reporting. You have full transparency into your expenses, helping you understand where your team is spending and what adjustments might be needed. These insights lead to more strategic decision-making and allow you to reach your financial goals with more ease.

Additionally, expense tracking apps improve compliance with tax regulations. Certain criteria must be met for employee reimbursements to be non-taxable to employees and deductible by your company. An expense tracking program ensures that you have all of the required documentation, maximizing compliance.

How to Choose the Right App for Your Business

When making your expense tracking app selection, ensure it meets your business’s needs. For example, if you need a program that has OCR receipt capture to improve documentation compliance, an expense tracking app that doesn’t offer this wouldn’t be a good fit. Your small business expense management tools should house all of the core features you need. You don’t want to be using numerous programs.

Moreover, many expense tracking apps offer free trials to test usability. Take advantage of these offerings to see if the app is the right fit for your business. If the program isn’t user-friendly, doesn’t have the key features you need, and is too expensive, you may need to continue your search.

Conclusion

Investing in an app to manage business expenses is important, especially as these programs can overhaul your inefficient and outdated procedures of manual reimbursements and expense tracking. Even better, a robust program can optimize your financial workflows and add much-needed transparency to your expenses.

There’s no one-size-fits-all approach when it comes to selecting the right expense-tracking app for your business, which is why it’s important to shop around and take advantage of free trials. Try a free demo of N2F to streamline your business finances!